International Association

of Regulation & Governance

Inaugural Conference

Regulatory Governance in a Changing World

Penn Program on Regulation

Regulatory Issues in Full Electrification

By

Branko Terzic

The U.S. government has set as a goal a “net zero” carbon goal by 2050 to meet the challenges of global climate change due to CO2 emissions. This would entail replacement of fossil fuels (coal, natural gas and petroleum) with non-carbon emitting energy sources made up chiefly of wind and solar with the possibility, without universal agreement, of construction of new nuclear power plants. The “transition plan” as it is sometimes called would be:

- Retirement of coal and natural gas fueled power plants

- Replacement with “renewable” sources (wind & solar)

- Retirement of internal combustion engine vehicles

- Replacement with electric powered vehicles

- Retirement of natural gas space heating and cooking

- Replacement with electric devices and appliances

- Retirement of industrial use of natural gas

- Replacement with renewable or non-carbon energy

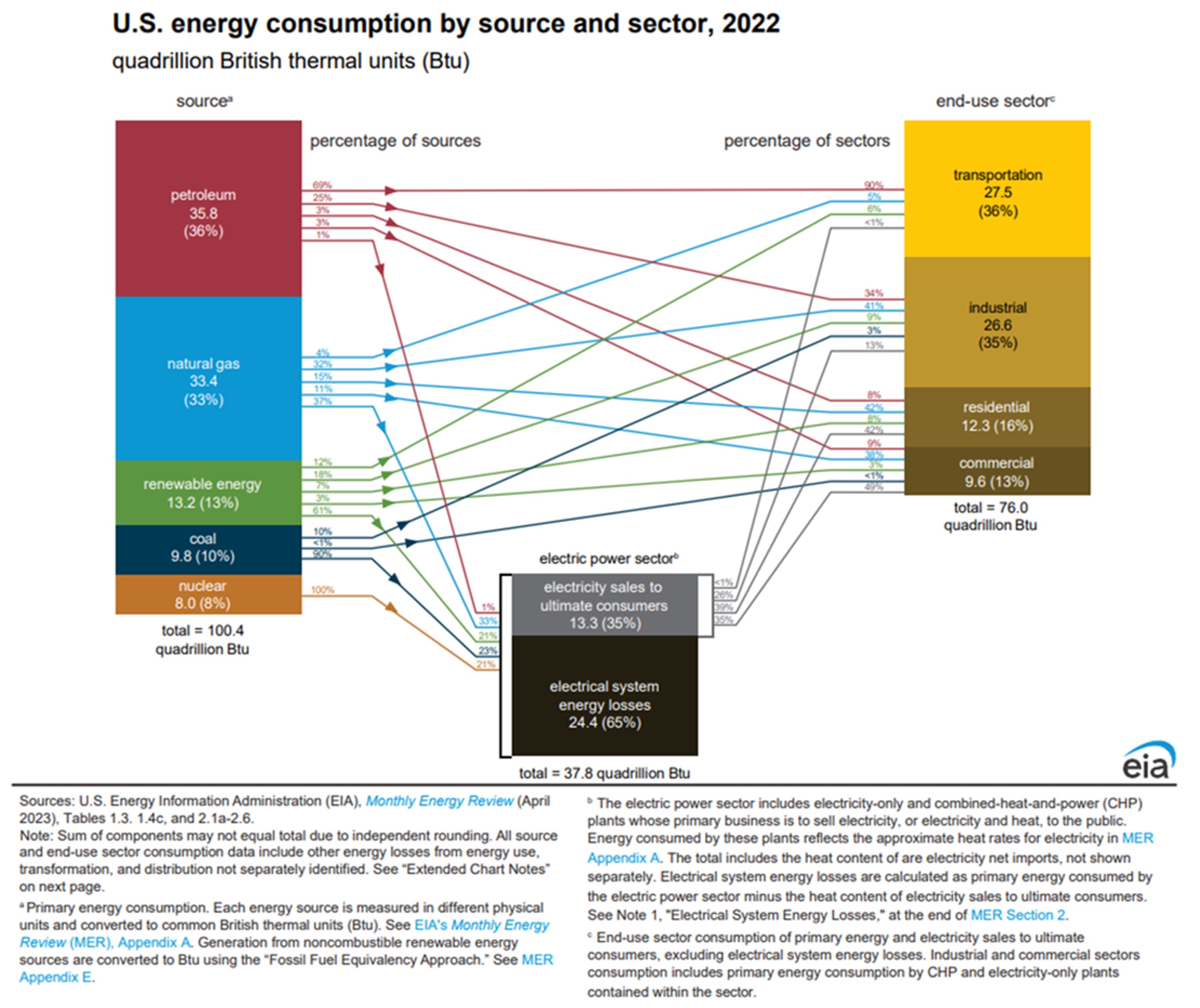

The replacement would require the construction of new e renewable power sources. In the chart this means the replacement of the “red” and “blue” bars showing quads of BTUs energy, with “green”. The new investment in renewable energy production (wind and solar), would most likely not be in proximity to consumers. New investment in electric transmission would be required to bring production to consumers. There is also the requirement for new investment in expanding capacity of the distribution grid to support higher local electricity demand from “electrification”

Regulation

The scheme of regulation of the US electric power industry was based on historic structure of electric industry from the early 1900s. In many states the structure of the electric industry changed with introduction of “restructuring” in the 1990’s. However, regulation did not change to accommodate new industry structure. Thus, today’s regulatory scheme is a mismatch authority and impact.

Background

The electricity industry in the US was privately funded due to the fact that early electric service was considered a luxury especially when the only service provided was electric lighting. The original customers were either businesses and wealthy consumers or municipalities looking to install street lighting which had demonstrated value in reducing street crimes at night. These new investor-owned electric utilities (IOU) were state based and vertically integrated. The IOU assets included all necessary generation, transmission to state’s population centers and distribution grid bringing electricity to residences, commercial and industrial customers. The IOU also may have had some municipal owned electric distribution utilities as wholesale customer. While generating with company owned power stations to meet all local demand the IOU would on occasion buy or exchange electricity with adjacent IOU for economic or when own power plants were shut down for maintenance. Originally regulated at the municipal level, beginning with California, New York and Wisconsin in 1907, state legislatures set up state regulatory agencies to regulate the new public service companies (electric, gas and telephone) with state public service commissions (also called public utility commissions).

State Regulation

The state public service commissions (PSCs) engaged in integrated resource planning, approval of construction authorization for new power plants including siting, approval of construction authorization for new electric transmission lines including granting of state authority of eminent domain including siting. This the state PSC would regulate IOU asset acquisition, construction, and set retail rates (producing 95%of revenue.)

Federal Regulation

The US Congress approved the establishment of the Federal Power Commission in 1920 (later renamed the Federal Energy Regulatory Commission FERC) to regulate wholesale sales of electricity. The setting of these rates was mostly to protect small municipal wholesale customers from monopoly pricing by IOU. Wholesale sales were not a major revenue source for most IOUs before restructuring. The FERC also was given authority to set prices for “third party access” to transmission lines for “wheeling” (municipal issue).

Restructuring

As of 2023 thirteen states determined that independent power plant operators could produce electricity at lower cost than if power plants remained under owner of the IOU. They required the IOU’s to sell generators. Upon sale of the power plants the new system required these power plants to sell electricity to IOUs at wholesale putting them under FERC jurisdiction. (Mistakenly called “deregulation”). The states restructured today are: Connecticut, Delaware, District of Columbia, Illinois, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, and Texas.

In the 13 states which had restructured their electric industry the sold, and any newly built “independent”, power plants were now under FERC jurisdiction. Under the 1920’s statute FPC/FERC must find that rates for wholesale power sales were “just and reasonable.” The historic method of establishing that rates were “just and reasonable” was by the FERC’s inspection of “cost of service.”

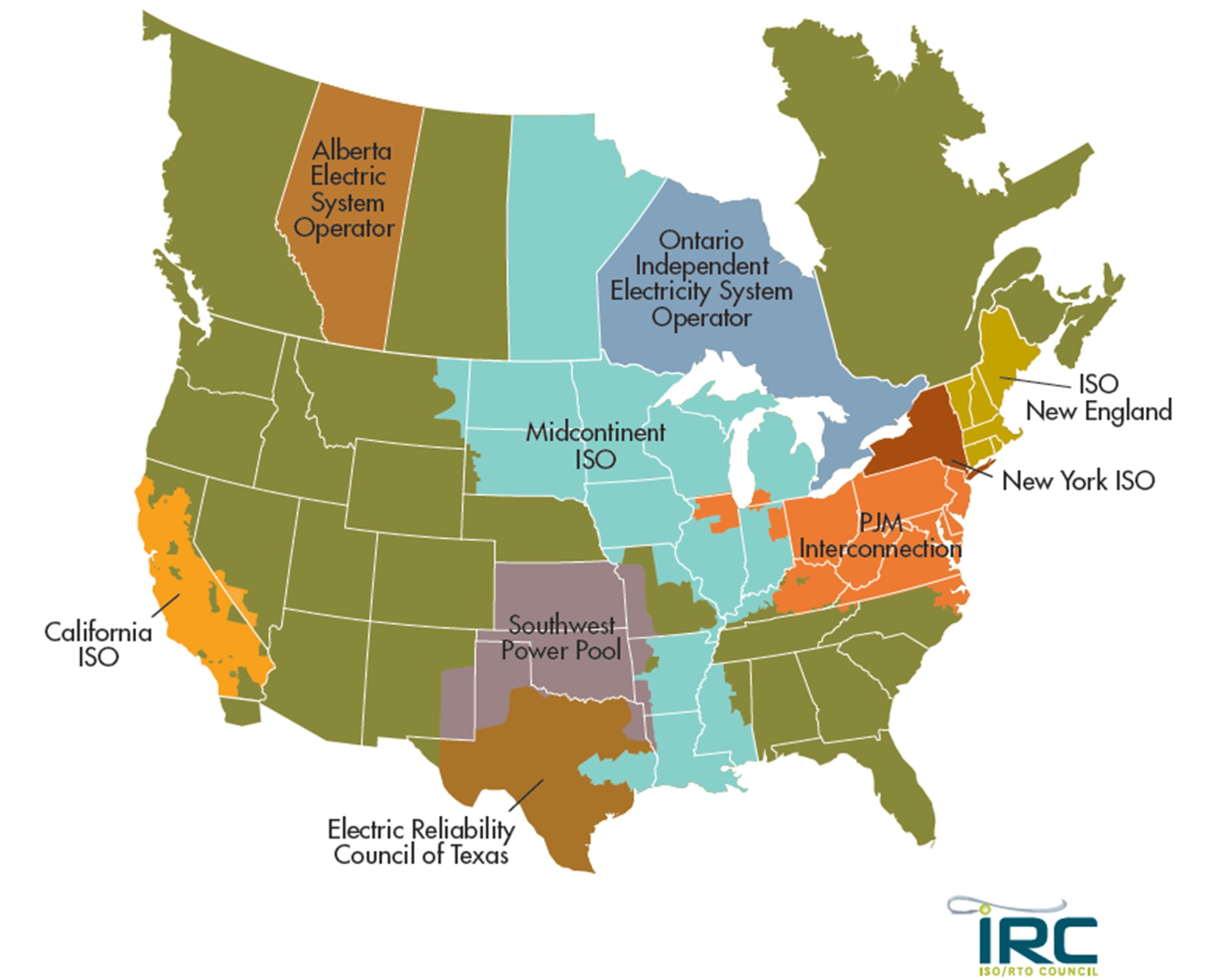

However, the establishment of wholesale power markets led the FERC to use “market-based pricing” as basis for “just and reasonable” and this new method was approved by US Supreme Court. Thus, the FERC regulates as “just and reasonable” the rates of the US power markets “Independent System Operators” or “Regional Transmission Organization” by careful monitoring of the market operations, traders and trades.

Full Electrification

The full electrification of the US economy would call for massive new investment to replace the existing fleet of fossil fueled power plants with large solar and wind systems. However, the locations of great wind and solar resources are far from population centers. Thus, to bring electricity from distant solar and wind centers will require construction of new electric transmission lines crossing multiple states. A recent series of articles in April, May and June 2024 issues of Public Utilities Fortnightly Magazine co-authored by my colleague Dr. R. Bruce Williamson estimate that cost of this new transmission at trillions of dollars.

New Generation Costs

Current installed coal and natural gas generation 762,251 MW, so the investment needed to replace existing fossil fueled generation is between $1-$3 Trillion.

- Replace with Wind at $1.5-$3.0 M/MW

- 1 for 1 is $1.1 -$2.28 Trillion

- Replace with Solar at $1 M/MW

- 1 for 1 is $762 Billion

To replace petroleum for transportation and natural gas for space heating and cooking would require expanding electric generation by a factor of five. At a cost of an additional $2-$4 Trillion.

Future Requirements for Full Electrification

- Estimating Five times current capacity of 1,270,418 MW needed

- All wind 1 for 1 is $2-$4 trillion

- All solar 1 for 1 is $1.27 trillion

For comparison purposes the total Market Capitalization for all 44 IOU EEI member Companies was $890 Billion end of 2023.

Regulatory Mismatch

State regulatory authorities (PSCs, environmental and siting agencies) will be asked to permit construction of new large solar and wind facilities for the benefit of consumers in other states. State regulatory authorities will also be asked to approve the siting and construction of new electric transmission (or expand capacity of existing transmission capacity) for the benefit of consumers in other states possibly far removed geographically.

Under current federal law the US national electricity regulator, the FERC, does not have authority over approval of the construction of transmission or generation assets which have regional or national electricity benefits. It is the state regulators (PSC) which have approval authority over construction of assets which have regional and national benefit but local environmental impacts.

Congress has attempted in the past to identify “national security corridors” for electricity transmission where there is a federal interest, but it failed to provide FERC explicit authority to preempt adverse state decisions.

This mismatch in regulatory authority leads to serious contentious issues as the states are asked to approve new infrastructure perceived as having benefits for distant out-of-state constituencies.

The Honorable Branko Terzic is a former Commissioner on the U.S. Federal Energy Regulatory Commission and State of Wisconsin Public Service Commission, in addition to energy industry experience was a US Army Reserve Foreign Area Officer ( FAO) for Eastern Europe (1979-1990). He hold a BS Engineering and honorary Doctor of Sciences in Engineering (h.c.) both from the University of Wisconsin- Milwaukee.

#BrankoTerzic #energy #regulations #experience #research #future #opportunity #strategy #consumer #business #marketing #digitalmarketing #consumerism #customer #b #branding #consumerbehavior #retail #consumers #consumerprotection #shopping #brand #fashion #entrepreneur