Depreciation Analysis: Unique to Public Utility Regulation

By

Branko Terzic

Depreciation can be a fascinating subject. Or not. To the average citizen the subject comes up in polite, but heated, conversation only when discussing the loss in value of the consumer’s second biggest investment - a new vehicle - as the value drops instantly when one leaves the automobile showroom floor. The family home, the biggest consumer investment, however, for years been the subject of “appreciation” rather than “depreciation”. Of course, in this discussion the term “depreciation” refers to a “loss in value”, which is only one its definitions. It the other definition that deserves more attention in regulated utilities.

The Interstate Commerce Commission described depreciation when applied to “value” in the following terms:

“Depreciation is the loss in service value not restored by current maintenance and incurred in connection with the consumption or prospective retirement of property in the course of service from causes against which the carrier is not protected by insurance, which are known to be in current operation, and whose effect can be forecast with a reasonable approach to accuracy.”

In the case of regulated public utilities depreciation refers to one of the four categories of cost or expenses which make up the estimated annual revenue requirement: the basis for setting rates for public utilities.

GAAP (AICPA) Accounting Terminology Bulletin No. 1 provides this definition of “depreciation” when used in accounting for determination of annual expenses:

Depreciation accounting is a system of accounting which aims to distribute the cost or other basic value of tangible capital assets, less salvage (if any), over the estimated useful life of the unit (which may be a group of assets) in a systematic and rational manner. It is a process of allocation, not of valuation. Depreciation for the year is the portion of the total charge under such a system that is allocated to the year.

In this accounting definition depreciation expense is based on the original cost of the asset as shown on the balance sheet. For utility ratemaking purposes depreciation expense takes its place as one of the four annual cost categories for ratemaking. The other three annual expenses are Operating & maintenance expense, taxes and return on rate base (investment).

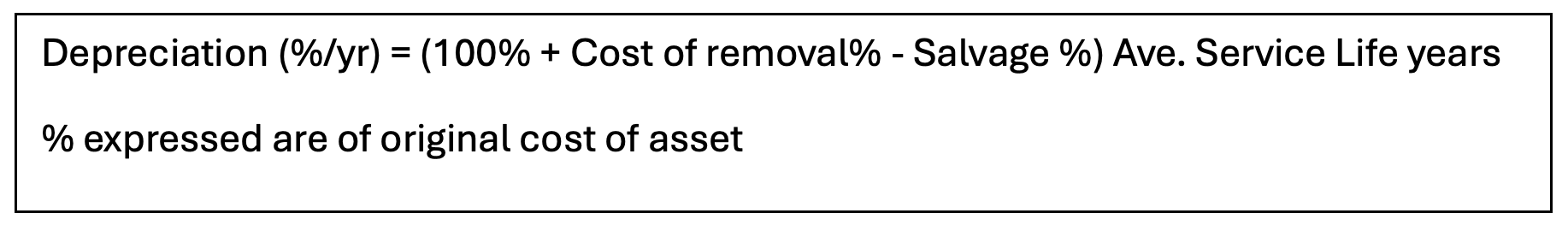

To calculate depreciation expense the GAAP definition requires an “estimated useful life” as well as an estimate of “salvage” which includes the net of gross salvage and cost of removal. An expert in depreciation analysis is thus needed to estimate the future economic service life, salvage and cost of removal of each designated asset on the public utility’s balance sheet. This is no small task as service lives and net salvage are affected by changes in technology, economics, changes in usage, weather, regulations and consumer preferences among other factors as well.

Why is depreciation expense important?

In 2023 the Edison Electric Companies, serving 85% of US consumers, reported over $64 Billion in depreciation expenses. This is a significant number as last year Operating and Maintenance expenses were reported at $100 Billion and Net Income at $55 Billion.

That $64 Billion covers the annual expense associated with the allocation of the capital investment of the EEI member companies in generation, transmission, distribution and other assets whose rates for service at set by state regulators. The state regulators, public service commissions/public utility commissions, also have the responsibility for setting the annual depreciation rates for all those assets.

The purpose of the depreciation, as explained by GAAP, is to allocate the cost of assets over the useful lives so that the customers receiving the benefit of the service form the assets pay for the assets which they are using them. This is frequently cited as the “matching” principle. Others have expressed it as “the cost causer is the cost payer.”

Incorrect estimates of service life can lead to assets being retired before they are fully depreciated, in which case the regulator is faced with a decision concerning the “stranded cost” or the unrecovered amount of the original cost of the assets.

An incorrect estimate resulting in full depreciation with the assets remaining in service has less of a negative impact in that the asset is no longer in rate base and the consumer neither pays any future depreciation expense on it nor has to pay any return on the fully depreciated asset. But the matching principle is still violated.

Given the complexity and significance of depreciation, the estimates of annual depreciation expense for the numerous and complex asset accounts of regulated electric utilities are best left to experts trained in depreciation analysis. In that case we have a problem. Most state public service commission and electric utilities do not have permanent staff trained in depreciation.

At one time a few university engineering departments such as those of Iowa State University and Michigan State University offered courses in depreciation and valuation. That is no longer the case. The only professional training and certification now available is from the Society of Depreciation Professionals www.depr.org established in 1987.

Recently, to track changes in economic service lives, utilities have relied on regulators’ three-, five- or six-year depreciation study requirements performed by outside consultants. This is inadequate. Depreciation is subject to continuous changes in technology, finance, legislation and administrative rule-making as well as management policies. Management and regulators must be informed in real time, not three or six years later, by a consultant, about changes in the economic useful life of the assets.

The 44 EEI member companies need, in my opinion, more attention paid b full time staff in monitoring their $1.4 trillion investment in assets and current annual $64 Billion depreciation expense. That goes for the 51 state regulators too.

The annual meeting of the Society of Depreciation Professionals will be held in Milwaukee Wisconsin September 15 - 20, 2024.

The Honorable Branko Terzic is a former Commissioner on the U.S. Federal Energy Regulatory Commission and State of Wisconsin Public Service Commission, in addition he served as Chairman of the United Nations Economic Commission for Europe ( UNECE) Ad Hoc Group of Experts on Cleaner Electricity. He holds a BS Engineering and honorary Doctor of Sciences in Engineering (h.c.) both from the University of Wisconsin- Milwaukee.

#BrankoTerzic #energy #regulations #experience #research #future #opportunity #strategy #management #people #electricity #power #utilities #renewables #RenewableEnergy #energysector #oilandgas #powergeneration #energyindustry #oilandgasindustry #sustainability #legislation